El Al's War-Era Momentum: Procuring 3 new Dreamliners, Expanding Market Share, and raising new capital

CEO Dina Ben Tal Ganancia has announced a deal with Boeing for three 787-9 Dreamliners valued between $650-730 million.

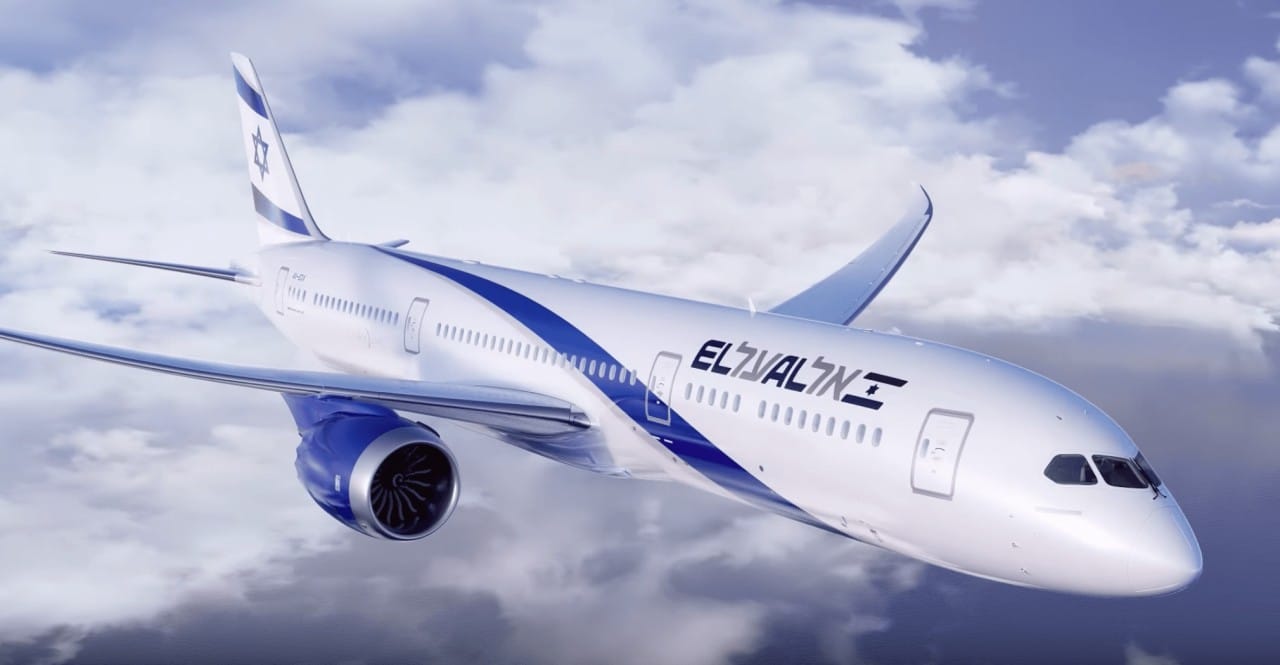

El Al, led by CEO Dina Ben Tal Ganancia, has recently announced a deal with Boeing. The agreement entails a preliminary order for three 787-9 Dreamliners valued between $650-730 million. These aircraft are slated for delivery between 2029 and 2030. Furthermore, El Al holds options to acquire an additional six similar aircraft, with delivery contingent upon the exercise of these options in 2030. This move underscores El Al's strategic vision for fleet modernization and potential expansion, showcasing confidence in the airline's future trajectory.

Thus, El Al fleet of 16 Dreamliners, which will expand to 19 by 2026 and could reach 28 by 2030

El Al is experiencing a notable surge in its share price, reaching levels not witnessed since the onset of the Covid pandemic, which severely impacted global tourism and aviation. Since the beginning of 2024, El Al's share price has surged by 48%, propelling the company's market capitalization to NIS 1.3 billion. Remarkably, since hitting its lowest point following the outbreak of the war in October, El Al's market capitalization has doubled.

Now the company is about to raise some $100 millions by issuing new shares on the TASE.

El Al's plan to raise capital coincides with the announcement of the Boeing deal, which suggests that part of the funds raised could be allocated towards financing the advances for the purchase of the Dreamliners. However, in the short term, the raised capital is likely to have various potential uses that could benefit both the company and its major shareholder, Kenny Rozenberg, who holds approximately 48% of El Al shares. Rozenberg has already expressed his intention to participate in the $100 million offering, which will be spearheaded by Leader Capital Markets.

This upward trajectory in El Al's share price and financial performance is attributed to its privileged position as the primary carrier operating at Ben Gurion airport in recent months. With few competitors, El Al has been able to command high fares for its flights to and from Israel. Many other airlines, including popular choices among Israelis such as low-cost carriers, have yet to resume flights to Israel amidst ongoing conflict.

This situation contrasts sharply with El Al's initial forecasts at the onset of the war, where it anticipated adverse impacts on its fourth quarter and expected challenges in the first quarter of 2024. However, the landscape swiftly transformed as foreign airlines suspended their flights to Israel, allowing El Al's market share at Ben Gurion airport to soar to 80% in November and December, compared to 21.5% during the same period in 2022. Despite the ongoing conflict, El Al managed to carry more passengers in the fourth quarter of 2023 compared to the corresponding quarter of 2022, commanding higher fares and resulting in a net profit of $40 million.

El Al's significance as Israel's national carrier extends beyond mere transportation. It serves as a symbol of national identity, connecting Israel with the world economically, diplomatically, and strategically. Through its operations, El Al contributes to Israel's accessibility, security, and international relations while playing a vital role in times of crisis and normalcy alike. Its impact on the economy and its reputation for security further underscore its importance to the nation.